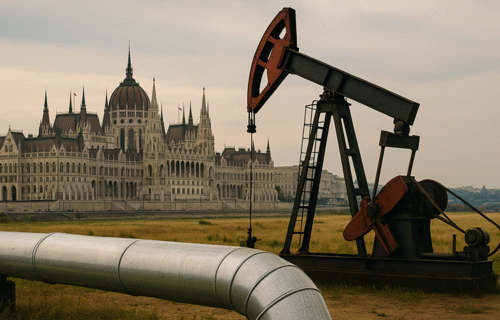

The United States has granted Hungary a one-year exemption from sanctions linked to Russian oil and gas purchases, following Prime Minister Viktor Orbán’s meeting with U.S. President Donald Trump in Washington in early November. According to U.S. and Hungarian statements, the exemption applies mainly to pipeline deliveries via Druzhba and TurkStream — infrastructure that supplies a large share of Hungary’s crude oil and gas.

Orbán publicly framed the decision as an agreement that Washington will not penalise Hungary for continuing to import Russian energy. The U.S. side described the move more cautiously as a one-year exemption, not an unlimited waiver. Media reports indicate that as part of the negotiations Hungary committed to purchasing additional U.S. liquefied natural gas and exploring greater cooperation on nuclear fuel supply.

Energy security is a critical factor in Budapest’s position. Hungary remains heavily dependent on Russia for pipeline crude and gas. Orbán argued after the meeting that geography and infrastructure leave Hungary with few short-term alternatives, a claim echoed by Trump, who said that Hungary lacks access to seaports and faces logistical limits on switching suppliers quickly.

The exemption places Hungary at the centre of a wider debate about how far Western governments can enforce sanctions on Russian energy revenue without destabilising countries that have high dependence on pipeline imports. Several EU members in Central and Eastern Europe, including Slovakia, are still tied to Russian gas flows and have resisted plans for a fast phase-out of Russian energy. In Slovakia’s case, political leaders have warned that an abrupt removal of pipeline supplies would threaten energy stability, pushing Brussels to consider transitional arrangements.

Outside the EU, the scale of Russian energy purchases by large emerging economies adds further complexity. India has become a major buyer of Russian crude since 2022, with refiners increasing orders when discounted cargoes are available. Analysis of shipping and trade data shows that Russian barrels continue to flow to India in volumes significant enough to soften the impact of Western sanctions. Some refiners briefly paused orders this year to assess exposure to new U.S. measures, but overall imports have remained high.

China remains the largest single buyer of Russian fossil fuels, taking deliveries both by sea and through pipeline networks. According to independent trade monitoring groups, China’s continued purchases represent a substantial portion of Russia’s export revenue and are a principal reason why sanctions have not fully constrained Moscow’s energy earnings.

Turkey also plays a role by importing discounted Russian crude and refined products, further illustrating how regional energy demand continues to sustain Russian export flows despite Western efforts to curtail them.

For investors, particularly those active in Central European real estate or corporate sectors, the Hungarian exemption temporarily reduces the risk of a sudden price shock or supply disruption driven by sanctions enforcement. However, the arrangement is explicitly time-limited. It does not eliminate longer-term transition risk associated with reliance on Russian energy, nor the possibility that investors could face renewed uncertainty when the exemption expires.

Diplomatically, the carve-out highlights the tension between geopolitical sanctions objectives and immediate energy-security needs. It offers a precedent that other countries could cite when seeking similar concessions and underscores how energy infrastructure — rather than policy ambition — may ultimately determine the pace of Europe’s decoupling from Russian supply.

Source: Reuters, AP, Politico, The Guardian and CIJ EUROPE Analysis Team