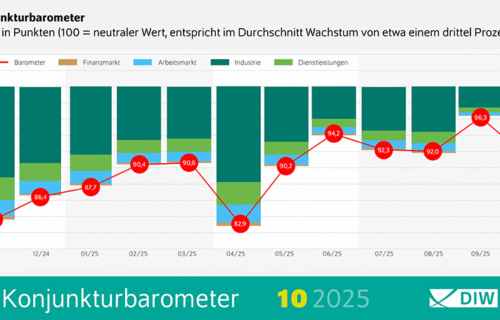

Germany’s economic outlook took a step back in October, according to new research from the German Institute for Economic Research (DIW Berlin). The institute’s monthly barometer, which tracks short-term growth signals, fell noticeably after reaching its highest point of the year in September. The drop places the indicator below the level associated with stable economic expansion, underscoring that Europe’s largest economy remains under pressure.

Analysts at DIW Berlin say several factors continue to weigh on business activity. Germany’s exporters are grappling with cooling global demand, intensified competition from China, and tensions surrounding U.S. trade policy. Domestically, companies are waiting to see whether the government’s recently announced reform agenda will translate into real economic stimulus. So far, signs of improvement remain limited.

Industry data paint a mixed picture. While incoming orders from German customers have improved slightly, foreign demand remains soft, and overall order books are still declining. After a surge in July, industrial production weakened again in August, and many firms continue to report cautious assessments of their current situation. Business expectations, however, have brightened, suggesting that confidence in future growth may be returning. Purchasing manager surveys have also edged up, hinting at tentative optimism among manufacturers hoping that fiscal support will revive local demand.

The service sector has shown small gains after a weaker summer, though the overall mood remains subdued. Inflation has inched higher again, household sentiment remains negative, and job market conditions have yet to show convincing signs of recovery. Economists note that service providers are likely to see only gradual improvement as fiscal measures begin to filter through to consumers and businesses.

Despite these challenges, DIW Berlin expects the economy to regain traction in the coming months as government investment programs start to take effect. Experts caution, however, that the rebound is likely to be uneven and heavily dependent on whether global trade conditions stabilise and domestic spending recovers enough to offset the drag from exports.

Source: DIW Berlin