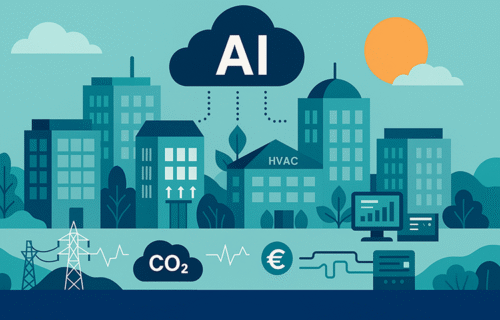

Artificial intelligence (AI) is playing a transformative role in helping the real estate sector reduce greenhouse gas emissions and improve operational efficiency, according to a new KPMG report.

Buildings account for nearly 40% of global emissions, with heating, cooling, and power consumption making up 27%. As urbanization accelerates – with 68% of the world’s population projected to live in cities by 2050 – the decarbonization of real estate is seen as critical to climate action.

KPMG’s Global Decarbonization Hub highlights that AI-driven solutions, especially human-centric AI, can deliver measurable results. For example, AI-powered software such as “Jenny” has achieved energy savings of more than 240,000 MWh, reduced greenhouse gas emissions by 90,000 tonnes, and generated €26 million in cost savings for real estate managers across 23 countries.

Case studies show how AI can autonomously optimize HVAC systems in commercial properties, making adjustments every 15 minutes based on weather forecasts, occupancy patterns, and energy market fluctuations. In one 10,000 m² office building, AI reduced heating consumption by over 60% while maintaining comfort standards. A shopping center of 60,000 m² achieved a 70% reduction in heating valve use and near 100% indoor climate comfort.

Experts from Tallinn University of Technology, Eduard Petlenkov and Juri Belikov, stressed that AI’s success depends on reliable, explainable systems that prioritize human comfort and trust. “By adhering to human-centric AI principles, building control systems can create healthier, more comfortable, and sustainable indoor environments,” Belikov noted.

The report underscores that AI alone is not enough: strategic energy management (SEM) frameworks are required to maximize impact. SEM integrates organizational change, training, and holistic efficiency planning with technology, enabling up to 30% annual energy savings in some buildings.

“AI is no longer a ‘nice to have,’ it is an essential strategy for cutting emissions, mitigating climate risk, and future-proofing real estate portfolios,” said Francesca Galeazzi, Partner for Real Estate, ESG & Climate at KPMG Germany