The German office property market in 2024 is characterized by rising rents and stable prime yields, despite ongoing economic uncertainties. Demand for office space remains strong, particularly in major cities like Berlin, Munich, and Frankfurt, where high-quality office properties continue to attract investors.

Rising Rents Amid Economic Challenges

Despite sluggish economic growth and geopolitical uncertainties, the office market in Germany’s top cities—Berlin, Düsseldorf, Frankfurt, Hamburg, and Munich—has shown resilience. Berlin and Munich, in particular, witnessed strong demand for large office spaces exceeding 10,000 square meters, fueled in part by public sector leasing activity. This trend has contributed to a moderate increase in rental prices across key business districts.

Vacancy Rates Rise Slightly, but Premium Spaces Remain in Demand

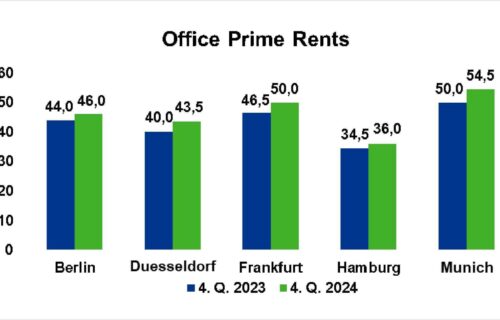

With an increased supply of newly completed office buildings, the average vacancy rate across Germany’s five major office markets rose by 90 basis points to 7.7% in 2024. However, premium office spaces continued to see high pre-letting rates, reflecting strong demand for modern, well-located properties. Limited availability of top-tier office buildings pushed prime rents up by an average of 6.8% year-on-year.

Prime Yields Hold Steady

Prime yields for German office properties remained stable throughout 2024, following a minor increase in early Q1. By year-end, the average prime yield across Germany’s top five office markets settled at 4.4%, reflecting investor confidence in the sector despite market fluctuations.

Outlook for 2025: Continued Growth in Prime Locations

Looking ahead, the demand for premium office space in prime locations is expected to drive further rent increases in 2025. Additionally, improved financing conditions following ECB interest rate cuts could revive transaction activity, leading to increased competition and potential downward pressure on yields.

With the continued flight to quality and ESG-compliant office spaces, the German office property market is set to remain a key focus for both domestic and international investors in the coming year.

Source: Union Investment Real Estate

Photo: Newly positioned TRIIIO office building in Hamburg