The beginning of 2026 will bring a decrease of mortgage loans interest rates applied in Romania, both on fixed interest rates segment, which represent over 98% of loans granted at this moment, and also on the variable interest rates segment, as a result of the decrease of the benchmark index for loans to consumers (IRCC), shows a market report issued by online broker Ipotecare.ro and financial consultant SVN Romania | Credit & Financial Solutions.

Thus, IRCC will decrease to 5.67% in the first quarter of 2026, a similar value to that registered at the beginning of this year. Fixed interest rates applied on the mortgage segment will also decrease in the first months of next year, to an average of about 5.55% according to SVN Credit Romania’s calculation, from a level of about 5.70% in the last quarter of this year.

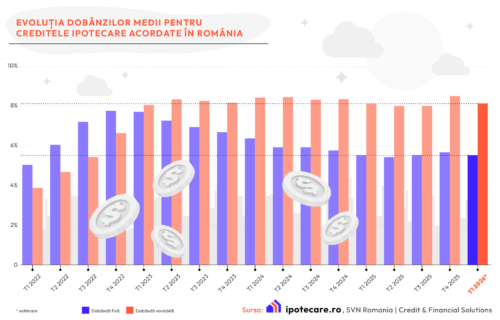

The 5.55% level estimated for the average fixed interest rate at the beginning of 2026 will be the third lowest registered in the last four years in Romania, while the variable interest rate, estimated at 8,17% and calculated as IRCC plus a fixed a rate of 2,5%, will be the fourth lowest value recorded since the beginning of 2023.

The second quarter of next year could bring a further decrease in mortgage rates interest rates according to SVN’s calculations based on the current IRCC daily values, the potential level for IRCC in 2nd quarter being of about 5.58% – IRCC is calculated based on daily values registered two quarters ago.

2025 was characterised by a stability in the first nine months of the year for mortgage interest rates, the fixed ones registering values between 5.45% and 5.70% throughout the year, while IRCC indicator varied between 5.55% and 6.06% in the last months of the year.

”2025 will set new records in terms of total volumes of mortgage loans granted in Romania, both for new loans accessed for home transactions and also for all forms of refinancings and conversions. 2026 is set to be at least as a good year, in the absence of macroeconomic events with strong negative impact – in the short term, the most important factor will be the evolution of the inflation rate, which will also determine the evolution of the loan interest rates,” said Alexandru Radulescu, managing partner SVN Romania | Credit & Financial Solutions, the exclusive partner of Ipotecare.ro.

2025 will most likely set a new record for mortgage loans granted in Romania. The most recent data published by the National Bank show that mortgage loans worth EUR 9.2 billion were granted in the first 10 mnths of 2025, up 26% compared to the similar period from 2024 – please bear in mind that this volume also includes refinancings, conversions, transfers and restructurings.

Home sales decreased by an annual rate of 2.7% in Romania after the first ten months of this year, while the number of residential units traded in Bucharest – Ilfov region decreased by an annual rate of 5.7% in the first ten months of 2025.