One in five European companies planning to expand their office footprint say they are doing so because they cut too much space or saw a stronger-than-expected return to office, according to CBRE’s 2025 European Office Occupier Survey. This is a significant jump compared with last year’s results and highlights the difficulty employers face in balancing hybrid work policies with real-world attendance.

Business and headcount growth remains the primary reason for expansion, but over-contraction has become a noticeable driver. For companies still downsizing, hybrid working patterns and cost discipline remain the leading factors.

The survey also shows a widening gap between employers’ expectations and actual attendance. More than half of respondents want employees in the office at least three days a week, yet fewer than half are achieving that. The gap is especially pronounced in financial services, where many firms are pressing hardest for in-office work.

Other global consultancies report similar trends. JLL’s latest occupancy benchmark highlights a rise in office use as companies apply stricter hybrid rules, while Cushman & Wakefield’s occupier research points to stabilisation in attendance alongside growing demand for higher-quality, service-led office space.

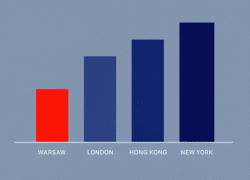

Return-to-office mandates by large employers are helping to drive demand in prime city locations. In London, for instance, vacancy in the core market has tightened, while older and more peripheral stock is struggling. This mirrors the broader European “flight to quality” trend, with tenants increasingly targeting modern, sustainable buildings that support flexible work and meet ESG requirements.

That emphasis comes against a backdrop of constrained development pipelines. Both CBRE and Cushman note that the supply of new office stock remains limited, raising competition for the best space and reinforcing rent growth in top locations.

While some companies are cautiously adding back space, many are consolidating into fewer, higher-quality buildings and using flexible solutions to manage uncertainty. Occupiers are focusing not only on square metres, but also on location preferences of employees, total cost of occupancy, and sustainability credentials.

The bottom line: European occupiers are moving past the contraction cycle of recent years toward stabilisation and selective growth. Those that over-corrected on space are now reversing course, while the wider market is defined by cautious strategy, greater emphasis on prime assets, and continued pressure to balance hybrid policies with employee behaviour.